For many entrepreneurs, the dream of taking their startup to the next level is embodied by the prospect of an Initial Public Offering (IPO). In this article, we’ll delve into the intricacies of what an IPO entails, why it’s a significant milestone for many companies, and the various factors that come into play on this transformative journey.

What is an IPO and Why Does it Matter?

Exploring the Basics

An IPO, or initial public offering, marks the pivotal moment when a privately held company makes its shares available to the public for the first time. Prior to this, ownership is typically restricted to a small group of individuals including founders, employees, and select investors. However, the moment a company goes public, ownership transitions to a wide spectrum of shareholders, making the stock accessible to anyone interested in investing.

The Enigmatic Nature of IPO

Often likened to a grand movie premiere, an IPO is the unveiling of the company’s inner workings to the public eye. Once private financial information is now available for scrutiny, transforming the company’s operations into a transparent spectacle for the market to analyze and evaluate.

The Allure of Going Public

Unveiling the Reasons Behind the Move

Access to Capital

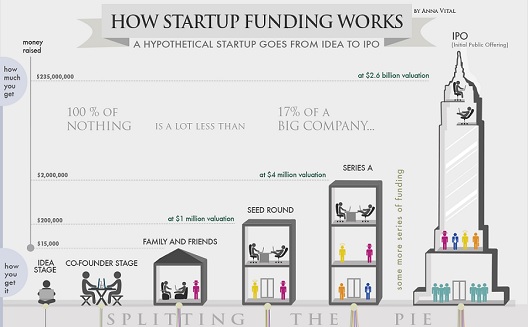

The primary incentive for many startups to pursue an IPO is the ability to raise substantial capital. With access to public markets, companies can leverage this opportunity to secure large sums of investment, often amounting to hundreds of millions of dollars, fueling further growth and development.

Creating Liquidity

Another significant advantage is the newfound liquidity of the company’s stock. With a quantifiable dollar value attached, this liquidity not only attracts more investors but also offers a lucrative opportunity for founders, employees, and initial investors to capitalize on their early involvement.

Establishing Credibility

Beyond financial gains, going public can significantly enhance a company’s credibility and reputation within the industry. Being listed as a public company adds a certain prestige and trustworthiness, making it an attractive prospect for potential investors and partners.

Understanding Valuation Dynamics

Deciphering Market Capitalization

In the realm of IPOs, the concept of valuation assumes paramount importance. When a company goes public, its value is determined by market demand and supply. If demand surpasses supply, the stock price rises, while an excess of sellers can cause a decline in price.

The Dynamics of Pricing

The pricing mechanism in the stock market revolves around the interaction between buyers and sellers. As these parties settle on an agreeable price, a trade is executed, setting the stock price at the current value. This intricate balance between demand and supply ultimately dictates the valuation of the company, reflected in its market capitalization.

Weighing the Pros and Cons

Unveiling the Pitfalls

While an IPO is undoubtedly an enticing prospect, it is essential to acknowledge the potential downsides that come with this transition from private to public.

Scrutiny and Short-Term Pressures

Once a company goes public, it is subjected to strict quarterly reporting and scrutiny, compelling management to deliver consistent and impressive financial results. This often leads to short-term thinking, which can be challenging for businesses focused on long-term growth and innovation.

Regulatory Compliance and Costs

Publicly listed companies are bound by an array of stringent regulations, necessitating substantial financial investments in legal and financial services. The costs associated with compliance can be burdensome, especially for companies transitioning from the realm of private ownership.

Navigating the Path to an IPO

Building Blocks for Success

Achieving an IPO is not an overnight feat; it requires meticulous planning, strategic decision-making, and substantial company growth. Here are the fundamental milestones that pave the way for a successful IPO journey:

Building a Solid Foundation

At the heart of every successful IPO is a robust company built on the pillars of exceptional talent, innovative products, and sustainable growth. This serves as the fundamental prerequisite for any company venturing into the IPO space.

Key Indicators for IPO Readiness

In addition to a solid foundation, certain key indicators serve as benchmarks for IPO readiness. These include a minimum revenue threshold of around $100 million, substantial growth rates of at least 30% annually, a clear path to profitability within a reasonable timeframe, and a diverse and predictable portfolio of products.

Beyond the Norm: Exceptions to the Rule

Exploring Alternate Avenues

While the stringent criteria of major stock exchanges can seem daunting, it’s worth noting that smaller markets often offer more accessible routes to an IPO. In regions such as London or the Nordic markets, there are platforms such as AIM in London and First North in the Nordics that provide a more feasible path to going public.

Conclusion: The Journey Continues

The decision to go public through an IPO marks a significant milestone in the life cycle of a company, symbolizing a shift towards greater visibility and accountability. While the allure of an IPO is undeniable, it’s crucial for entrepreneurs to weigh the pros and cons carefully before taking the leap. Whether it’s the promise of heightened capital, increased liquidity, or enhanced credibility, the road to an IPO demands unwavering commitment, resilience, and a steadfast vision for long-term success.