In the fast-paced world of startups, securing adequate funding is often a critical determinant of success. Navigating the complex landscape of funding rounds can be daunting for entrepreneurs, especially when it comes to understanding the intricacies of each round and its implications. In this comprehensive guide, we will delve into the nuances of startup funding rounds, exploring the process, expectations, and crucial tips for entrepreneurs to maximize their chances of securing the right funding at the right time.

Deciphering Startup Funding Rounds

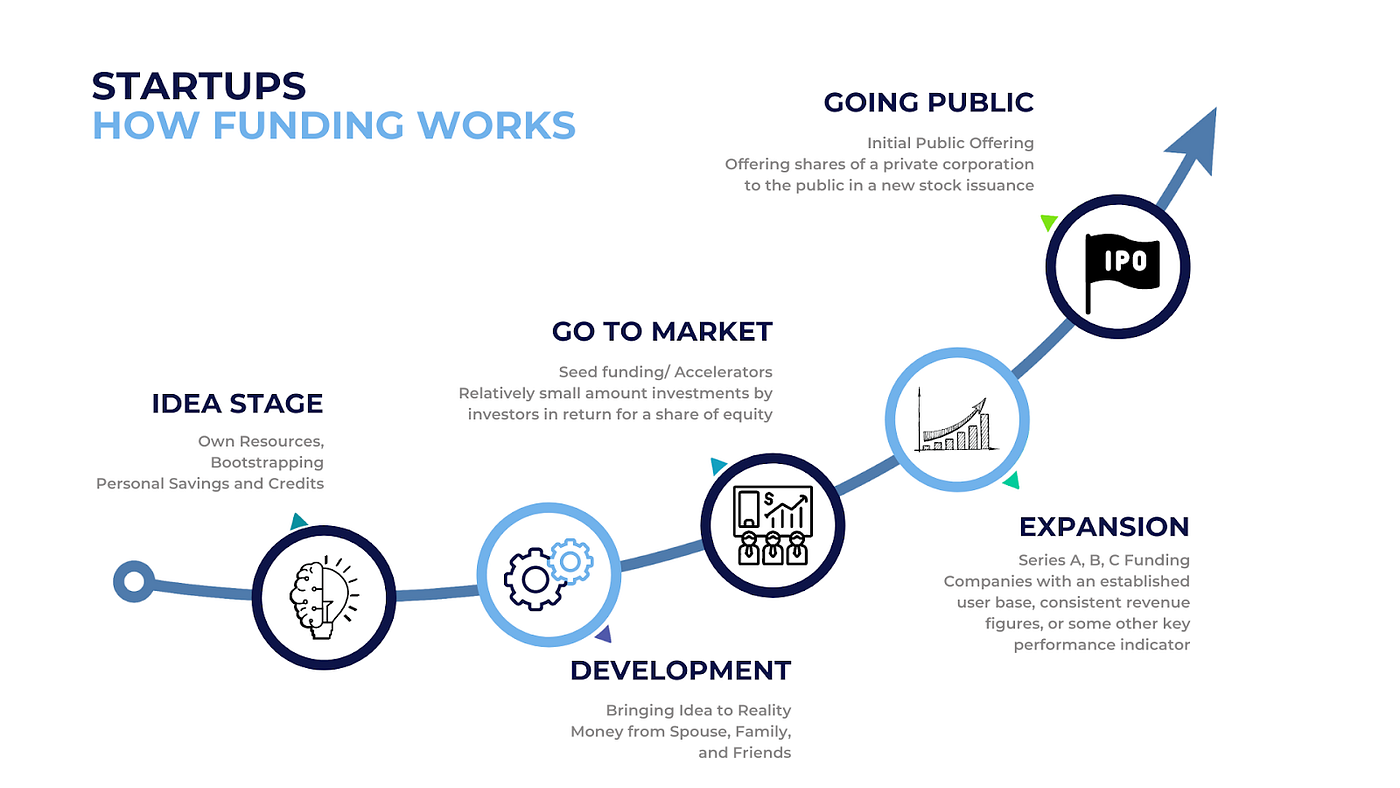

Startup funding rounds are sequential stages of funding that companies go through to secure capital for growth and development. These rounds typically involve different types of investors, each contributing capital at various stages of a startup’s journey. Understanding the distinct characteristics of each funding round is essential for entrepreneurs to make informed decisions about their company’s financial future.

The Initial Stages: Idea and Friends & Family Rounds

At the initial stages, the startup is often just an idea with minimal or no product development. Self-funding and support from friends and family members form the primary sources of capital. These early investors often invest in the founder’s vision and potential, making the friends and family round a crucial stepping stone for the budding entrepreneur.

The Emergence of Angel Investors: Angel Funding Round

As the startup progresses, it enters the angel funding round, characterized by the involvement of angel investors. These investors, typically seasoned entrepreneurs or high-net-worth individuals, infuse capital in exchange for equity. While this stage marks a more professional phase, entrepreneurs must be cautious not to give away substantial equity too early, preserving it for subsequent funding rounds.

Seeding the Growth: Seed Funding Round

The seed funding round represents a pivotal stage where startups start gaining the attention of venture capitalists. At this point, there might be a minimal product or a proof of concept. However, the revenue is still limited, and the company’s market presence is in the initial stages. Entrepreneurs often seek local or regional venture capitalists who specialize in early-stage investments, ensuring a strategic fit with the company’s goals and values.

The Milestone of Success: Series A Funding Round

Reaching the Series A funding round is a significant achievement for any startup. At this stage, the company demonstrates a solid proof of concept and a promising product-market fit. Professional investors, including venture capitalists, carefully scrutinize the startup’s traction and potential for growth. Securing investment at this stage indicates a validation of the company’s business model and its viability in the market.

Scaling Up: Series B and Beyond

The Series B funding round marks a crucial phase where the startup transitions from proof of concept to revenue generation. With an established customer base and a solid revenue stream, the company attracts more substantial investments from venture capitalists and sometimes even private equity firms. This influx of capital fuels the company’s expansion and sets the stage for significant growth opportunities.

Beyond the Horizon: Series C and IPO

As the startup continues to mature, the Series C funding round becomes a milestone that signifies the company’s market dominance or leadership position. With substantial revenue and a clear path towards profitability, the company garners interest from both venture capitalists and private equity firms. At this stage, the possibility of an initial public offering (IPO) becomes a realistic goal, presenting the company with opportunities for further growth and expansion.

Key Considerations for Startup Founders

Navigating the funding landscape can be challenging for startup founders. Here are some essential considerations to keep in mind while navigating the funding rounds:

- Preserving Equity: Avoid giving away a significant portion of the company in the early stages to maintain control and motivation for future growth.

- Diversifying Investors: Aim to onboard new investors in every funding round to leverage premium investment opportunities and ensure a healthy capital influx.

- Local and Regional Focus: Consider seeking investors within your local or regional entrepreneurial ecosystem to establish valuable connections and support networks.

- Validating Traction: Emphasize building a strong proof of concept and demonstrating early traction to attract the attention of professional investors.

Conclusion

Understanding the intricacies of startup funding rounds is crucial for entrepreneurs aiming to secure the necessary capital for their ventures. By recognizing the distinct characteristics of each funding stage and implementing strategic measures to preserve equity and attract investors, startups can navigate the funding landscape more effectively and set themselves up for long-term success.