Introduction

When it comes to seeking funding for your startup, the process of reaching out to an angel investor can be a critical step. However, it’s not as simple as just firing off a message and hoping for the best. With the help of industry experts and insights from successful entrepreneurs, we have gathered valuable information on the most effective methods to contact angel investors and what key elements should be included in that crucial first message.

Finding the Right Channel

Understanding Angel Investor Preferences

Upon surveying a group of prominent angel investors, it became evident that the method of reaching out to them plays a pivotal role in capturing their attention. Here’s what we found:

- Facebook Messenger and Text Messages – With a rating of 1.5 and 1.9 respectively, these methods were seen as highly intrusive and generally not well-received by the investors. Unless it’s an emergency, it’s advisable to steer clear of these channels.

- Phone Calls – Despite being a traditional approach, unannounced phone calls received a lukewarm response, with a score of 1.9. Intrusiveness seemed to be a common concern among the investors.

- LinkedIn – While LinkedIn scored 2.3, it wasn’t particularly favored by most investors. It is suggested to use this platform sparingly, especially if other options are unavailable.

- Email – With a score of 3.0, email was generally accepted, although a small percentage of investors still expressed their reservations. If you choose to use email, ensure your message is compelling and concise.

- Bumping Into – Surprisingly, many investors indicated a positive response to this approach, with only a minority expressing some reservations. Although it requires courage, initiating a conversation at events or conferences could be an effective way to make a lasting impression.

- Getting an Introduction – The clear winner with a high score of 4.6, this method greatly enhances your chances of catching the attention of an angel investor. By obtaining an introduction from a mutual connection, your credibility and potential are immediately bolstered.

Crafting the Perfect First Message

Deciphering the Content

Having identified the best ways to reach out to angel investors, let’s delve into the crucial elements that should be included in your initial communication:

- Team – Highlighting your team’s capabilities and unique qualifications to solve the problem at hand should take precedence. With a score of 4.3, investors prioritize understanding the team’s potential to drive the project forward.

- Product – Communicate precisely how your product addresses a specific problem in the market. Be succinct and emphasize the uniqueness and effectiveness of your solution. A score of 4.3 signifies the significance of a compelling product proposition.

- Idea and Market – While the idea and the market are essential, they are not the primary focus during the initial outreach. A brief mention of the idea and the market’s potential can provide context, but it should not overshadow the team and product aspects.

Additional Insights and Advice

In addition to the preferred contact methods and the content of the first message, here are some valuable tips offered by experienced angels:

- Precision and Relevance – Keep your message concise and pertinent to the investor’s interests and industry preferences.

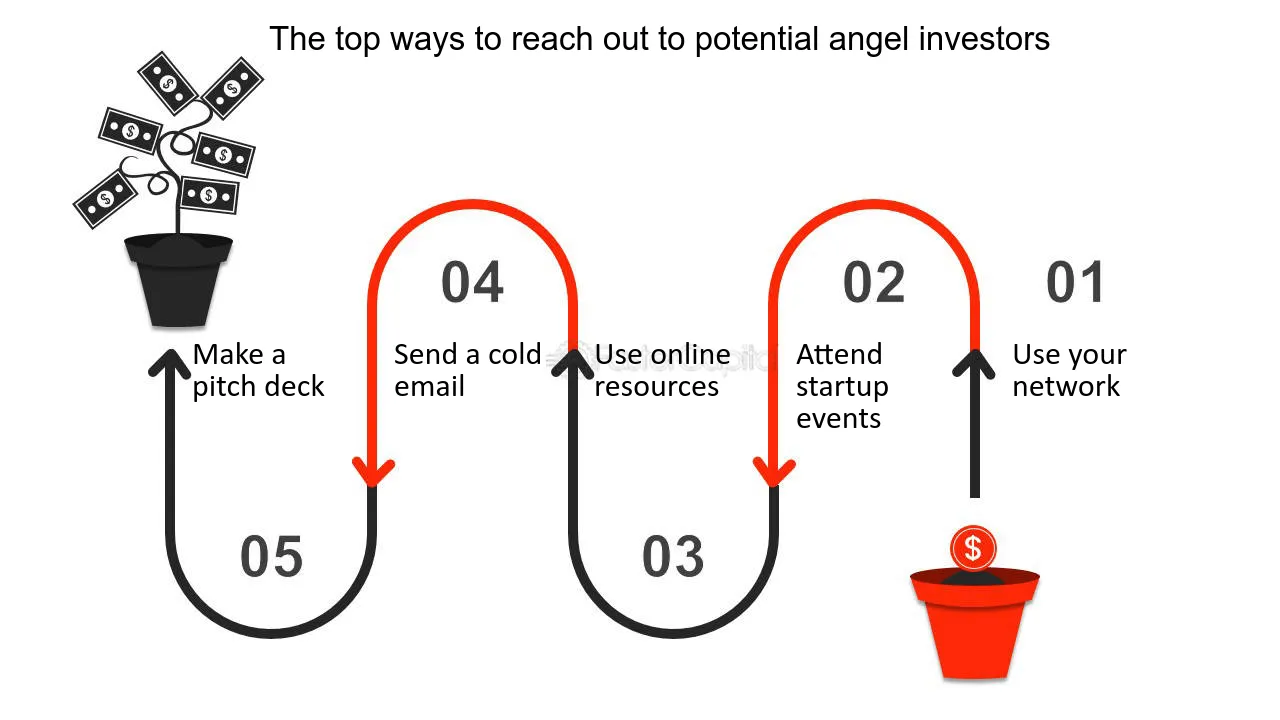

- Networking and Introductions – Foster connections within your industry to expand your network and increase the likelihood of securing an introduction from a mutual connection.

- Long-Term Relationship Building – Engage in meaningful interactions with industry peers and professionals, not just for immediate investment prospects but for long-term relationship building and industry insights.

By following these best practices and heeding the advice of seasoned investors, you can enhance your approach and increase your chances of securing the support your startup needs.